Mike Dugan, State Senator, District 30

2021 Legislative Score: 49

2021 Legislative Score: 49

March 20th, 2021

Alpharetta, GA – Secretary of State Brad Raffensperger was denied election as a delegate in his own precinct this morning at the Fulton County Republican Caucuses. Raffensperger failed to even secure a nomination for delegate.

“We are sending a message that will be heard all around the state. Raffensperger has got to go” said one participant.

Raffensperger‘s defeat comes as a shock given that Republican elected officials are often treated like royalty whenever they seek to be made a delegate to anything.

Raffensperger had sent a note requesting to be made a delegate but no one nominated him and he did not attend the caucus.

Turnout was very high at the caucus with 60-70% of participants being first time attendees.

Former Alpharetta Mayor David Belle Isle also announced that he would be a candidate for Secretary of State next year. Belle Isle ran for Secretary of State in 2018, losing the primary runoff to Raffensperger.

Congressman Jody Hice is also believed to be planning a run for Secretary of State.

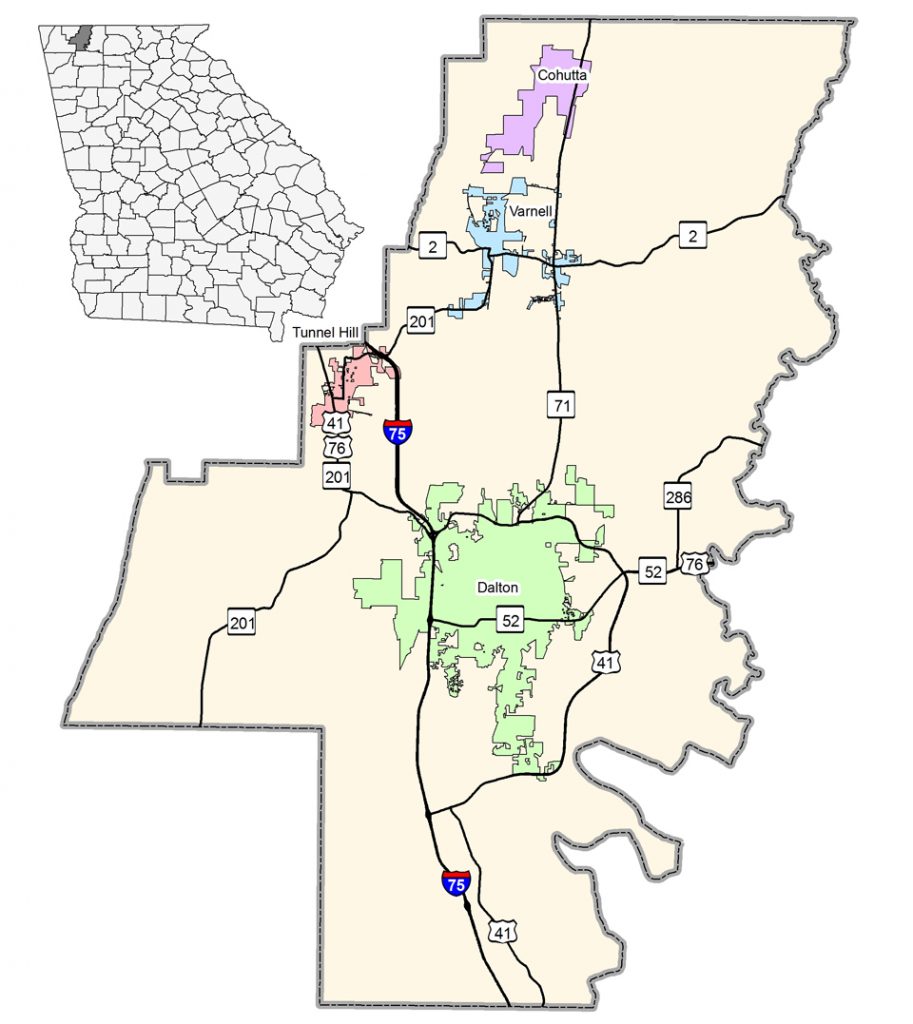

On Tuesday, Whitfield County voters once again rejected Redevelopment Powers that would have granted the Board of Commissioners the authority to create an additional Tax Allocation District within the County. GRA members in Whitfield County are overjoyed to see this kind of “Crony Capitalist” attempt get shot down by a majority vote with 1,986 people voting “No” and only 1,395 voting “Yes.”

Redevelopment Powers were approved by the voters for several Cities in 2014, but were rejected by the voters for the unincorporated areas of Whitfield County. The Dalton Daily Citizen reported that Chairman Jevin Jensen, prior to the vote, suggested that now that the County voters have seen TADs in use, they may be more receptive to the idea, but Tuesday’s election proved otherwise.

The March 16th special election was intended to fill the term of the late Commissioner Roger Crossen who passed away in office last year. This election, which was originally only going to be held in District 3 of the County was expected to have very low voter turnout, until Representative Kasey Carpenter seized the opportunity to include a question about controversial Redevelopment Powers.

The question was placed on the ballot due to the passage of HB61 in the 2021 legislative session which granted Whitfield County the authority to “…cary out community redevelopment, to create tax allocation districts, to issue tax allocation bonds,…” and required that this Act must be put before the voters for approval or rejection.

The author of the bill was GA State Representative Kasey Carpenter (R-Dalton), who is himself a Dalton business owner whose private hotel enterprise has, in the past, come under criticism for being the recipient of this kind of corporate welfare. In 2018 he was the recipient of Tax Increment Financing which uses tax payer dollars to help fund private enterprise for business owners in attractive occupational fields, who have the right connections and who can persuasively convince the local government officials that their business venture will eventually increase tax revenue. Many Whitfield taxpayers have had cause to wonder if they too could make a similar argument for why they should be spared the tax burden other citizens and businesses bear?

Couldn’t most of us, if given a tax break and additional financing from the government, stimulate the economy and eventually create more tax revenue for the County too?

In less than a month, this cronyist bill was fast tracked through the legislative process and then signed by the Governor. The co-sponsors were Rep. Carpenter’s fellow Northwest Georgia officials Rep. Jason Ridley (R-Chatsworth) and Rep. Steve Tarvin (R-Chickamauga) all of whom would appear somewhat out of touch with their more conservative constituency which disapproves of this kind of corporate welfare scheme.

When the Redevelopment Powers (TAD) question was added to the March 16 ballot, the election became county-wide which then forced all the voting precincts to open, not just those in District 3. The opening of these additional precincts is estimated to have cost the taxpayers an additional $25,000 in administration, for which Rep. Carpenter drew some additional criticism from the Whitfield GOP who called it “special interests”. For most of the County, the entire ballot contained only one referendum question and the voters were so strongly against it, they were willing to take time away from their jobs and families to show up and let their voice be heard in a decisive “No”.

Crony Capitalism (which really isn’t capitalism at all) is defined as:

An economy in which success in business depends on close relationships between business people and government officials. It may be exhibited by favoritism in the distribution of legal permits, government grants, special tax breaks, or other forms of state interventionism.

The idea behind “Redevelopment Powers” stems from a belief that it is the role of local government to “plan”, “develop”, or “create growth” within the economy. TADs are believed to be a tool at the Commissioners’ disposal to aid them in that task.

By Georgia law, less than 10% of the County can be included in a Tax Allocation District, which means that a small portion of taxpayers get special tax treatment and have the potential for government funds to help finance their operations. This kind of compartmentalization for special treatment is by definition discriminatory, and forces the other 90% of the County to bear an unfair tax burden.

The City or in this case the County, designates a specific geographic area that has the potential for redevelopment but suffers from blight or underinvestment. A TAD incentivizes developers by “freezing” the current property values and then as the properties are improved, the taxable value increases. Other unelected boards tasked with this kind of economic planning are sometimes called a Joint Development Authority, and are appropriately named because they create a marriage between private business and local government for the purpose of development which they claim is mutually beneficial. The loser in this kind of deal is usually the oblivious taxpayer and the hard working small business owner who does not have the team of lawyers, accountants and political connections to be able to secure government subsidies.

This type of scheme is becoming more and more commonplace. It is estimated that over $500 million in TAD bonds have been issued in the state of Georgia alone.

Because this type of cronyism occurs at the local level, it represents a great opportunity for conservative activists to engage effectively and restore free market principles for their community.

Our Founding Fathers recognized that alliances between big business and big government had enormous potential for corruption, partiality, and inequality. These alliances often lead to unjust judgment on the part of Government leaders which is warned against in Leviticus 19:15:

“Ye shall do no unrighteousness in judgment: thou shalt not respect the person of the poor, nor honor the person of the mighty: but in righteousness shalt thou judge thy neighbour.”

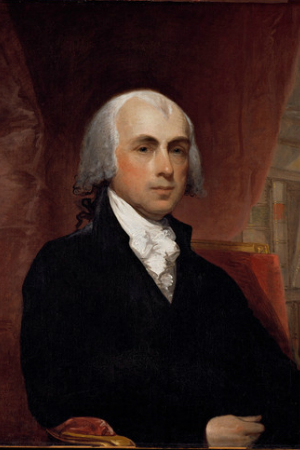

The Founders did not assign government the role of engineering the perfect economy, creating jobs or making loans to entrepreneurs that they believe to be worthy. Rather, the jurisdiction of civil government envisioned by the Founding Fathers was extremely limited focused primarily on justice and defense, and was economically neutral thereby allowing the organic free market to pick the winners and losers.

“A just security to property is not afforded by that government, under which unequal taxes oppress one species of property and reward another species: where arbitrary taxes invade the domestic sanctuaries of the rich, and excessive taxes grind the faces of the poor; where the keenness and competitions of want are deemed an insufficient spur to labor, and taxes are again applied, by an unfeeling policy, as another spur; in violation of that sacred property, which Heaven, in decreeing man to earn his bread by the sweat of his brow, kindly reserved to him, in the small repose that could be spared from the supply of his necessities.

… such a government is not a pattern for the United States.

“If the United States mean to obtain or deserve the full praise due to wise and just governments, they will equally respect the rights of property, and the property in rights: they will rival the government that most sacredly guards the former; and by repelling its example in violating the latter, will make themselves a pattern to that and all other governments.” – James Madison, National Gazette, 27 March 1792